Industry leaders share digital transformation priorities — and expectations

By any measure, advances in digital technology and the Industrial Internet of Things (IIoT) have transformed the industrial landscape. But the path to transformation is challenging. This is especially true for the cement sector, which has lagged behind other industries in digital implementations.

Heavily dependent on the fluctuating and diverse construction industry, vast stores of legacy equipment and siloed operations, cement companies often lack a unified vision for digital investments.

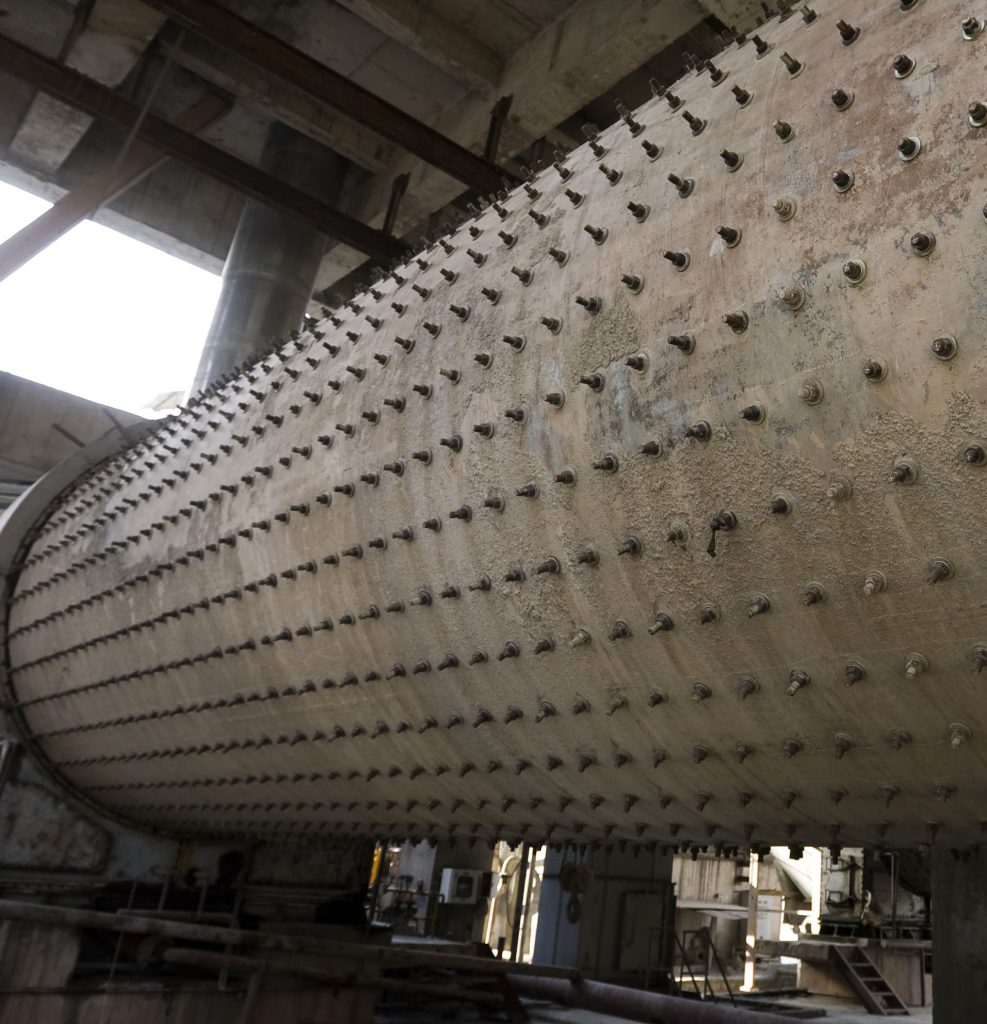

Recently, Rockwell Automation explored senior management perspectives about digital transformation and IIoT initiatives at their companies. In-depth interviews and global quantitative survey findings drawn from cement industry executives and experts point to key outcomes companies expect from digital investments, progress made, potential roadblocks — and a path forward.

Opportunities in a volatile environment

Cement plays the role of primary binding agent in aggregate- based building materials — including concrete, the second most consumed product globally after water. And for the cement industry, the good news is that despite market fluctuations, the long-term demand for its products is expected to continue.

The world’s increasingly urban populations and growing mega cities clearly require cement-reliant construction of all types. As infrastructure development increases worldwide, so does demand for concrete building foundations, roads, foot paths and bridges. As the need for affordable housing and commercial development expands, so do technologies like 3D printing and new product formulations.

There’s no doubt. Cement is a critical component of modern construction and modern life.

At the same time, we have seen the rise of “regional champions” who have gained a foothold in the developing world — making the market more competitive.

In 2019, the industry was already concerned by slowing demand triggered by a sluggish Chinese economy and impending trade wars. The market was further disrupted in 2020 with the onset of the unprecedented COVID-19 pandemic.

It is impossible to project the lasting impact the pandemic will have on the industry. And indeed, the aftershocks will vary regionally. But in the short term, municipal construction activity has been replaced in many areas by a community focus on new health protocols — and limited budgets and revenue. While governments may consider major infrastructure projects to bolster flagging economies, the cement industry nonetheless expects a double-digit decline in 2020.

Market uncertainty has made cement executives wary of new capital investments. Additionally, companies recognize the need for innovative solutions that can help improve plant utilization, optimize processes, reduce energy consumption — and ease compliance with CO2 and other emissions mandates.

But for risk averse cement companies, each investment made must deliver a measurable result that helps counteract the impact of cyclical demand.

“…evaluating the ROI of digital transformation investments is a challenge. Typically, cement companies look at proven concepts targeting specific topics like fuel consumption and equipment uptime.”

Former Senior Vice President Merger Integration Multiregional Cement Company

Defining digital value: business intelligence

Although adoption of digital technologies is uneven across the cement industry, there is growing consensus that digital transformation is key to more efficient operations. In fact, many large multiregional companies have embraced Industry 4.0 initiatives. While global players initially pursued digital transformation to improve supply chain integration, they have also steadily incorporated more “smart” technology on the plant floor.

But initial digitalization in the plant is often focused on individual technologies deployed in isolation to optimize one piece of machinery or process. This piecemeal approach is even more prevalent for regional companies.

However, according to our study, cement executives across the board are beginning to take a more holistic view — and prioritize digital investments that can improve decision-making and sustainability.

“… some companies are further ahead in digital transformation. Newer plants typically generate more data. But they don’t always know what to do with the data.”

Vice President of Supply Chain North America Region Global Cement Company

Company leaders know they must address operational challenges. And they expect investments in digital technologies — and especially data analytics — to provide answers to critical questions:

• How do we identify sources of inefficiency in our cement plants in real time?

• How do we analyze the risks associated with different potential environments and scenarios, including impacts to human safety?

• How can data be used for competitive intelligence in a commodity market?

• How can we improve maintenance schedules of capital equipment to be more predictive?

“Analytics are important not only for predictive maintenance, but also for sales, logistics and other functional areas. And to do analytics, you need consistent, connected data from different environments.”

Head of Business Transformation & Process Multiregional Cement Company

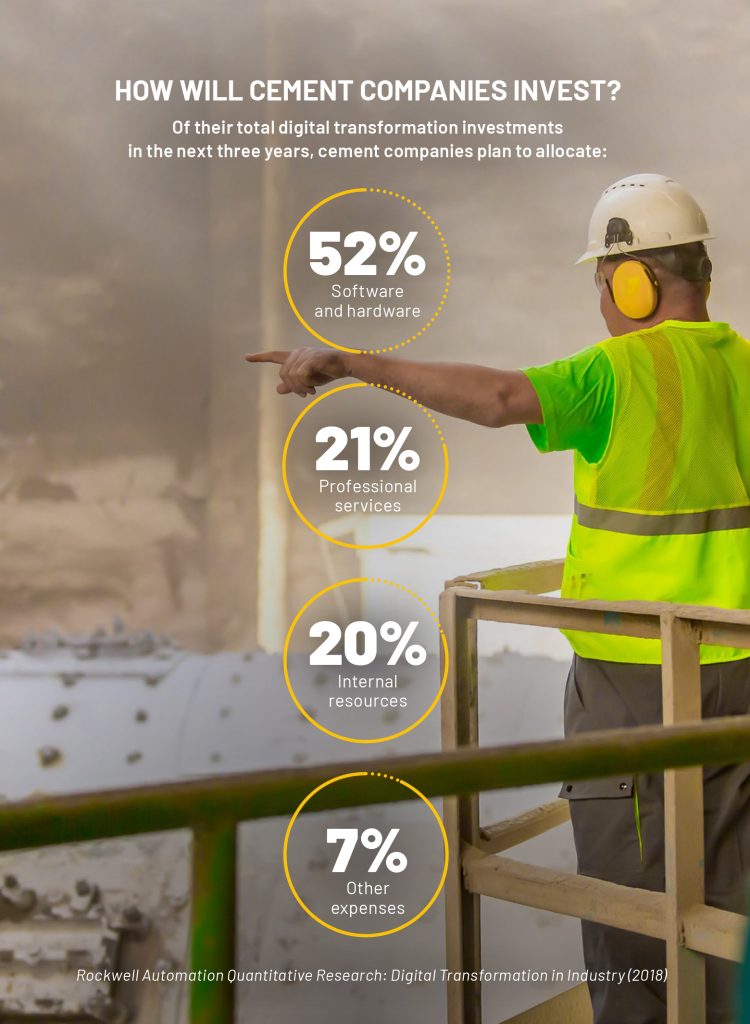

Top priorities for digital transformation

When it comes to prioritizing digital transformation outcomes, operational efficiency tops the list of both short-term and long- term goals. This has been true in the best of times and has become more critical now as the industry faces a traditional cyclical market— exacerbated by the impact of COVID-19. Both capital and energy intensive, the cement industry simply must improve the efficiency of existing assets to bolster profitability.

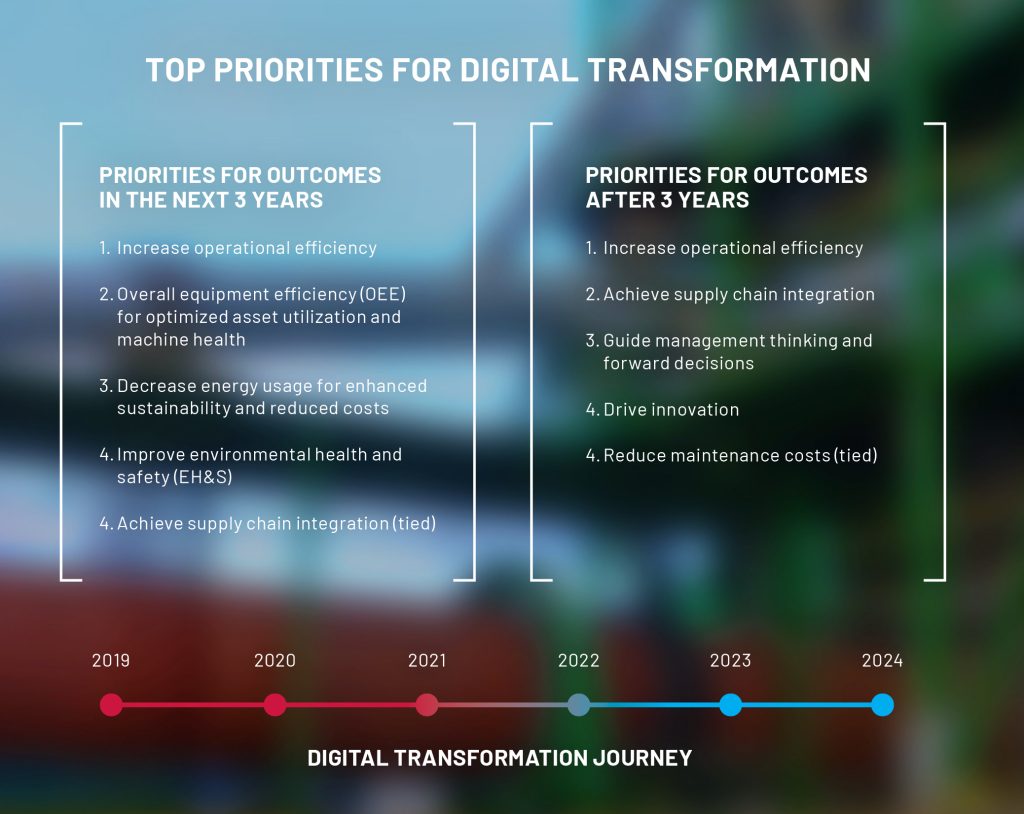

Given the extraordinary number of variables involved within a cement operation, pinpointing the sources of inefficiency — and improving asset utilization — is challenging. A typical cement plant does not have a lack of data. In fact, the amount of data generated by a modern cement kiln is staggering.

Today’s cement companies recognize that through digital transformation, they can achieve better analysis and modeling of that data — and uncover insights that optimize market responsiveness and performance.

“There is optimization potential due to digitalization. And all optimizations come back to money and more efficient production.”

Business Transformation & Innovation Officer Global Cement Company

SHORT-TERM FOCUS: EQUIPMENT OPTIMIZATION, ENERGY USAGE & SUSTAINABILITY

As a whole, cement companies’ additional short-term priorities (one to three years) support their need to address inefficiency at its source. Of course, executives expect digital investments to deliver better overall equipment effectiveness (OEE).

Some of the world’s largest cement companies have already made impressive progress in this area. For example, some are employing smart devices and connected systems to track and monitor equipment — and detect abnormal conditions. Better access to operational information has translated to more consistent process quality, improved maintenance and higher equipment availability.

Now, cement companies seek investments that further enhance maintenance activities by enabling a more predictive approach — and more integration with production planning and inventory control. As one former IT supply chain manager for a multinational cement company stated:

“…when someone needs to do maintenance on a part, if you don’t have an iteration with the warehouse, if you don’t have an iteration with the procurement flows, then your process is not good enough and is not efficient.”

Decreasing energy consumption and enhancing sustainability is a critical short-term priority. The cement industry is the most energy- intensive of all industries. And for a typical cement plant, energy accounts for about 20% to 40% of production costs.

Heavily reliant on fossil fuels, the industry is also responsible for about 8% of CO2 emissions globally.9 To improve sustainability, the cement industry has taken bold steps toward “green cement” processes that reduce carbon footprint, water consumption and waste — and support a circular economy.

As this industry expert noted, environmental initiatives are also impacted by regional pressure:

“So reducing your clinker factor, increasing ground limestone, and other things that help reduce the carbon output per ton of cement is occurring especially in places where there’s a carbon tax.”

Regardless of location, cement companies turn increasingly to IIoT technologies to capture and give context to energy data, improve the efficiency of existing processes — and meet environmental regulations.

In addition, companies are incorporating more smart equipment — and increasing the adoption of model predictive control (MPC) techniques to enable less carbon-intensive clinker production in the kiln.

In the short term, cement plant operators also prioritize investments that enable remote operations — and expose fewer people to risk.

LONG-TERM PRIORITIES: EXTENDING TRANSFORMATION ACROSS THE VALUE CHAIN

Along with operational efficiency, supply chain integration is cited as a short-term and long-term priority for digital transformation. In the longer term (four to six years), improving supply chain integration lags only behind operational efficiency as a desired outcome.

For cement companies, supply chain integration from quarry to product delivery is especially complex due to the diversity of the customer base — and localization of the industry. While cement and cement clinkers are regularly exported, products cannot be transported cost-effectively over long distances domestically. As a result, multinational companies have global portfolios — but they must find ways to efficiently distribute product and service customers at the local level.

Additionally, exactly how product is delivered — in bulk shipments or packaged and in what quantities — varies greatly on a regional level. This independent cement industry consultant explains the complex logistics:

“In developed markets, construction trends are highly technical and the business mostly is “B to B.” But in developing economies, business is mostly “B to C.” The issue is getting cement to new areas that are being urbanized — where people are building their houses little by little.”

To improve operational performance, cement companies prioritize investments in smart sensors, data historians, mobile devices, IIoT infrastructure and software applications. But they also invest in software and analytics to enable real-time visibility across their supply chain — and to integrate production and transportation systems.

Better supply chain integration also translates to an improved customer experience, which is a critical outcome and often a justification for digital transformation. As one industry supply chain expert put it:

“…the aim is to make the customer experience a little easier. If you have in-vehicle monitoring in your delivery truck, you can make sure it’s taking an efficient route. You can also notify the customer through an app, so they know where their order is and can plan accordingly.”

In the longer term, cement companies also expect their digital transformation journey to guide management thinking and decision- making — and support innovation.

Progress in the journey

While cement executives readily identify their priorities, progress made to date is less mature than other industries surveyed. Recent research has identified significant year-over-year gains. Still most cement companies — more than 60% — have yet to implement at least one completed digital transformation initiative.

The slower progress in the cement sector is not unexpected. Historically, harsh operating conditions and complex processes have made technological advancement difficult. In addition, the industry has been plagued in recent years by overcapacity, profit margins that rarely exceed 12% — and the perception that any investment in digitalization is cost-prohibitive.

Age-old situational challenges remain for companies that seek to enable digital transformation. And the typically longer timelines for cement companies are exacerbated by a fluctuating and localized construction market, which results in uncertain capital budgets.

More than 60% of cement plants have not completed at least one digital transformation initiative.

Rockwell Automation Quantitative Research: Digital Transformation in Industry (2019)

DATA INTEGRATION AND INVESTMENT CHALLENGES

A challenging business environment isn’t the only obstacle cement companies face. Our survey respondents also indicate data integration difficulties are limiting their ability to realize digital transformation — and a truly connected cement plant. Of those surveyed, 63% struggle to integrate data across multiple systems and 39% are challenged to integrate legacy equipment.

Why do so many cement companies struggle with data integration? For some, an exceptionally large installed base of proprietary systems is a significant roadblock. This comes as no surprise since cement plants can remain in operation for 50 years or more — and reflect the technology diversity of that lifespan. According to this executive:

“Most of these companies have a very heterogeneous landscape of tools and solutions – a legacy. Solutions that don’t talk to each other.”

Cement companies recognize they must invest in a secure IT/OT infrastructure to support data integration. However, justifying new digital investments is difficult in an industry that needs significant sustaining capital to maintain aging physical assets. In the words of one respondent:

“The chief information officer (CIO) is competing for capital just like the head of manufacturing and the head of distribution. Everyone is competing for scarce capital, and everything is very capital intensive in the industry.”

Furthermore, chief financial officers (CFOs) sometimes have difficulty relating to digital value that is not readily apparent in financial reports. For example, predictive maintenance that helps avoid an untimely repair can be difficult to quantify. It’s a “dynamic non-event.” Technology may have prevented a bad outcome — unplanned downtime — but nothing appears in the ledger.

ATTRACTING SKILLED LABOR

Cement companies must also address workforce impediments to progress. The two most common human resource challenges are finding new talent and helping management accept new ways of doing things.

Changing behavior among established employees — some who have been on the job for decades — is never easy. Redesigning processes is particularly challenging when a clear strategy is not in place. In fact, 30% of survey respondents indicate that the lack of a digitalization strategy is limiting their progress toward transformation.

In addition, cement plants have a hard time attracting highly- educated talent with the skills required to run a fully automated plant — and the desire to do so. More than one third of survey respondents say the lack of required skills is a key digital transformation challenge.

As one way to attract new interest, cement companies are partnering with other key players in the building industry to offer “accelerator programs” that support startups. Participants receive mentorship — and high-level access to market and technical expertise. Of course, the programs also benefit the cement companies. As this interviewee explained:

“The companies provide space and access to their network to tap into young potential talent. As an industry, you need to stay attractive to new talent with college majors in digital fields.”

36% of survey respondents say lack of required skills is a key digital transformation challenge.

Rockwell Automation Quantitative Research: Digital Transformation in Industry (2018)

SPOTLIGHT ON CYBERSECURITY

Since the cement industry has trailed other industries in digital implementations, cybersecurity concerns have also lagged.

However, our follow-up research study indicates that cybersecurity is now a significant concern as more plants begin to move from the planning phase to implementation.

Overall, 44% of respondents cite concerns about data and systems security as a top technical challenge affecting their digital transformation initiatives. And those companies now in the implementation or post-implementation phase list cybersecurity as their top concern.

The path forward

Ultimately, cement companies evaluate investments in digital transformation by the results produced – as they do any other major expenditure. But unlike some capital investments that are assessed only in the short term, digital transformation is a journey with incremental value accelerating along the way.

While cement companies continue to lay the foundation for digital transformation success, they describe an innovative future that will include:

• Increasing use of analytics to drive optimization across operations.

• Advancement of artificial intelligence to better manage energy usage.

• More use of virtual reality and digital twins to enable better prototyping and operator training.

• Further development of carbon capture technology and the use of alternative fuels for more sustainable operations.

• More smart sensors and smart safety technology on the plant floor to enhance working conditions.

• Expanding impact of building information modeling (BIM) across all sectors of the construction industry.

“I think all cement players are looking at how they can minimize their energy consumption — or at least turn to renewables. They need alternative ways to produce, without emitting CO2.”

Business Transformation & Innovation Officer Global Cement Company

The cement industry is at a technological crossroads. Those who make a long-term commitment to digital transformation will reap the benefits of a connected cement plant — and future innovations. An industry insider summarized the opportunities succinctly:

“… there is so much room for additional efficiency that can reduce costs — and also room to better understand and improve health and safety. And you can also optimize the quality of your cement delivery, so you can approach everything more logically.”

“Digital transformation means there is really a profound change to business processes, activities, organizational structures — the way we manage and the competencies we require to manage a cement company. It will absolutely impact the whole business.”

Former Senior Vice President Merger Integration Multiregional Cement Company

ABOUT OUR STUDIES

Rockwell Automation conducted primary research with more than 40 global industry professionals directly involved with the selection, design or execution of Digital Transformation/IIoT initiatives in the mining and cement industries. The research spanned an online quantitative survey (June-August, 2018) and 14 one-hour, one-on-one, in-depth interviews (November 2018). The 2018 research was hosted by GLG without participant knowledge of Rockwell Automation sponsorship. Rockwell Automation conducted a second online quantitative survey (August- September, 2019). The 2019 research was hosted by Ipsos without participant knowledge of Rockwell Automation sponsorship.

Source: Rockwell Automation

Tiếng Việt

Tiếng Việt